Description

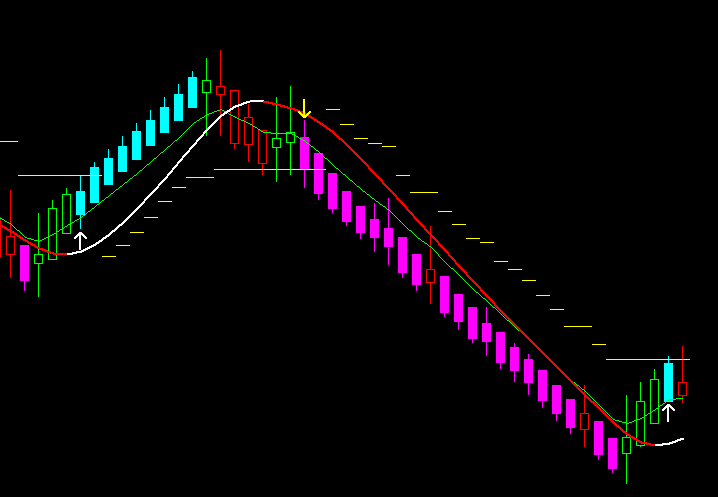

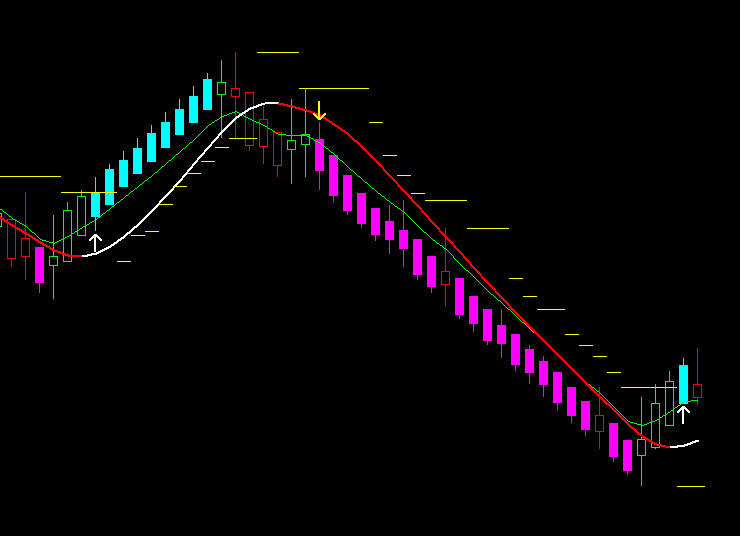

The S3 Auto-Trading System for Sierra Chart is designed to identify scalping entries. It can be used during trending and ranging conditions, as its goal is to identify short-term changes in momentum and quickly enter and exit when a target is reached. It is a not a complex system, nor is it perfect. It is not meant to be traded all day long, but to capture moves during the first few hours of the trading day when the volume is high. It is also meant to be used with discretion, as no system works well in all market conditions.

This S3 chartbook also has ribbons of the T3 system on the same chart to help identify opportunities to increase the number of contracts or the profit targets. If all three ribbons at the bottom are the same color, then that is confirmation of a longer-term trending opportunity, so the target and/or contracts may be increased.

The S3 rules are a combination of several specific rules, that signal an automatic long or short entry. The auto trader will optionally place the order for you, with your trade configuration (contracts, targets, and stops) set in the trade window.

What’s Included:

Limit Orders

In addition to Market Orders, you now have the choice of Limit Orders at your choice of entry prices (plus or minus an offset):

- Highest Volume at Price during the signal candle

- Open

- Close

- The midpoint of the High and Low

- The midpoint of the Open and Close

Also, the Bid/Ask price (without an offset) can be chosen: Bid Price for short entries, and Ask price for Longs.

Limit Orders that are not filled immediately are canceled automatically. You can change the default number of bars before cancellation to 1 or more.

Automated Trailing Stops

The S3 System also includes at no extra charge the enhanced Automated Trailing Stop study. This custom study has 4 different ways of computing where the stop price should trail, and it always moves in the direction of less risk, not the other way.

This custom study can be configured to look at the Volatility Indicator ATR, and with a programmable multiplier, move the stop further away when volatility is up, and tighten it up when volatility is down. A programmable Offset can be added to the Trailing Stop Price.

The study can also look back as many bars as you like to the highest or lowest bar, and keep a tighter stop.

Two other ways are a combination of the ATR and Bar Based stop. One looks at the closest to price action of the two, the other looks at the furthest away.

Additional Filters

Knowing when not to trade is important in all markets. The following rule-based filters are now part of the system:

- Two Periods of Adjustable Start/End Times for Auto trading with your choice of using either, both, or 24 hours.

- Your choice of entering with Longs Only, Shorts Only, or both Longs and Shorts.

- Option to avoid the first 15 Minute Open Range

- VWAP Rule: No Longs below/No Shorts Above

- Globex Rule: Often price reverses at the Globex levels. You may have a rule to avoid entering when approaching them. You can now choose No Long entries approaching Globex High from below and no Short Entries approaching Globex Low from above. The cutoff where you stop looking at entries is adjustable in ticks.

- 50/144 “Cloud” Rule: A popular indicator of trend, the 50 and 144 EMAs from the one minute chart appear as a red or green cloud on the chart. You can choose to only allow Longs above and Shorts below the cloud, and in the sync with the color (direction) of the cloud.

- Daily Max Profit and Loss – With programmable limits and Text Display. This is on a chart by chart basis.

Additional Levels and Overlay Studies Included

The following popular levels and overlay studies are now included in the chartbook. Some are hidden, so you can decide which ones you wish to see. Not everyone wants to see all the levels, but you can hide or unhide each one:

- Pivot Points

- Camarilla Pivots

- Yesterday’s High/Low

- Today’s High/Low

- Midnight Open

- 15 Minute Open Range

- 25 Minute Open Range

- 1 Hour Open Range

- 50/100/200 Day SMA

- Murrey Math Lines

Stop and Targets: Use the Trade Window to configure attached order Quantities, Stops, and Targets.

What Else?

All Forgiving Computers Indicators and Trading Systems are completely written in C++, the same way Sierra Chart itself and the built-in studies are programmed. They are compiled into 64-bit DLLs, which, with the new chartbooks are automatically downloaded after your purchase is processed. They are installed into any instance of Sierra Chart you are running on any computer that uses the same trading account. A DLL becomes part of the application and can be used in multiple charts simultaneously with no impact to performance, unlike with the older spreadsheet-based systems. DLLs are fast, meaning, they can make a trade decision more quickly and get your order placed faster than any human can when presented with the same information. If a minor change is made to the DLL, it can be automatically applied to your charts with no action needed on your part. It is recommended you be on the current version of Sierra Chart to avoid compatibility issues.

Sim Playback of S3 with VWAP filter:

Users may receive automatic future updates. The updated user guide is in My Downloads.

View the T3 System: Here

Save with the S3/T3 Bundle: Here

Pricing

The S3 Trading System is available with a Lifetime License, with free updates, and 1 year of email support for $199.99.