Description

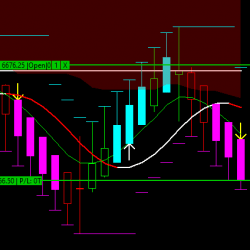

Two Trailing Stop Strategies in one. Trail your stop based on Volatity (ATR) or by Stepping up one bar at a time, as many or as few bars back as you like.

This set of studies is everything you need to trail your stops when trading manually or with auto traders. The same trailing stop that is included with the S3 and T3 auto trading systems is now available as a standalone package.

Set the trailing stop based on Volatility (ATR from another chart) or based on the Highest High or Lowest Low of the last N bars.

| Input Name | Input Description |

|---|---|

| Stop Type | Select which trailing stop method(s) to use: ATR with Multiplier: Set the Stop at the price equivalent to the ATR times a Multiplying Factor N Bars Back: Trail with the price of the Highest High or Lowest Low of the last N Bars (see Bars Back below). Closest or Farthest: Calculate both stops and use the closer (smaller) stop, or the further (larger) stop. |

| ATR Study | ID and SG of the ATR Study Overlay |

| ATR Multiplier | This number times the ATR will determine the stop price when using ‘ATR with Multiplier’ |

| Bars Back | How many bars back to look for the HH and LL for the Trailing stop |